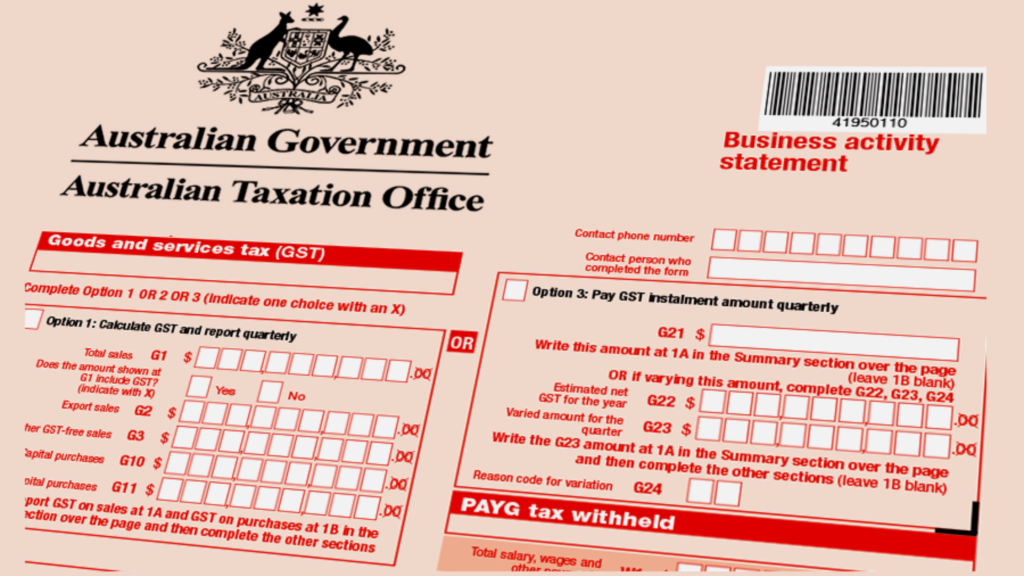

Business Activity Statements

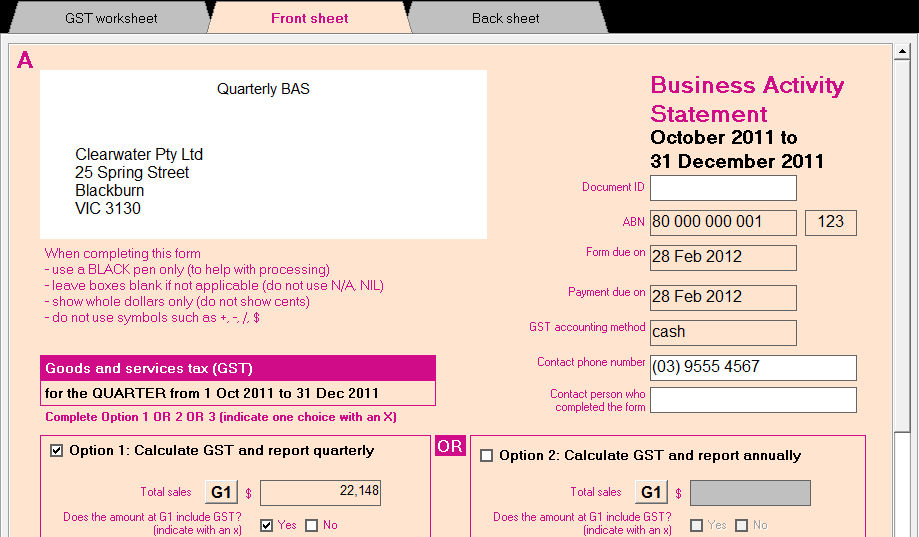

Stay on top of your GST, PAYG, and other tax obligations with our accurate and timely BAS services. We prepare and lodge your Business Activity Statements in full compliance with ATO requirements, helping you avoid errors, penalties, and unnecessary stress. Whether you need monthly, quarterly, or annual reporting, we ensure your business remains compliant and financially organized.

Why you will need an small business tax accountant to complete your return?

You can prepare and lodge your activity statements by using Mygov/Paper-based platforms. You have obligation to lodge your activity statement by the 28th of next month of the quarter ending i.e June 2023 BAS will be due on 28 July 2023.

You will need to lodge and pay the activity statement by the due date or enter a payment arrangement with ATO.

We, the tax agents, have an extension to lodge the activity statement. You can engage our expert services to prepare and lodge your obligations. If you are unable to pay your activity statements liability we can help arrange a payment plan on your behalf.

Confused about your obligation

Contact our small business tax accountant to know about your obligations