Fringe Benefits Tax (FBT) Returns

Ensure compliance with Fringe Benefits Tax regulations through accurate preparation and timely lodgment of your FBT returns. Our experts help you identify reportable fringe benefits, calculate your tax obligations correctly, and provide guidance to optimize your benefits structure—all while minimizing risks and penalties. Stay ahead with confidence knowing your FBT returns are managed efficiently and in full compliance.

What is Fringe Benefits Tax (FBT)?

Fringe Benefits Tax (FBT) is a tax imposed on employers who provide benefits to their employees or the employees’ associates, in addition to their regular salary or wages. These benefits are often non-cash perks such as company cars, housing, entertainment expenses, loans, or expense reimbursements. The purpose of FBT is to ensure that these additional benefits are fairly taxed, just like regular income.

FBT applies regardless of whether the benefit is provided directly to the employee or indirectly to their family members or associates. It is important to understand that FBT is separate from income tax and is calculated on the taxable value of the fringe benefits provided.

Do You Need to Lodge an FBT Return?

You are required to lodge an FBT return if:

You provide individual fringe benefits exceeding $2,000 to an employee or their associates during the FBT year, or

You offer a motor vehicle (car) for the private use of an employee, even if the benefit is under $2,000.

Even if your business does not have an FBT liability, it’s important to review your benefits annually to determine whether lodging is required, as penalties may apply for failure to comply.

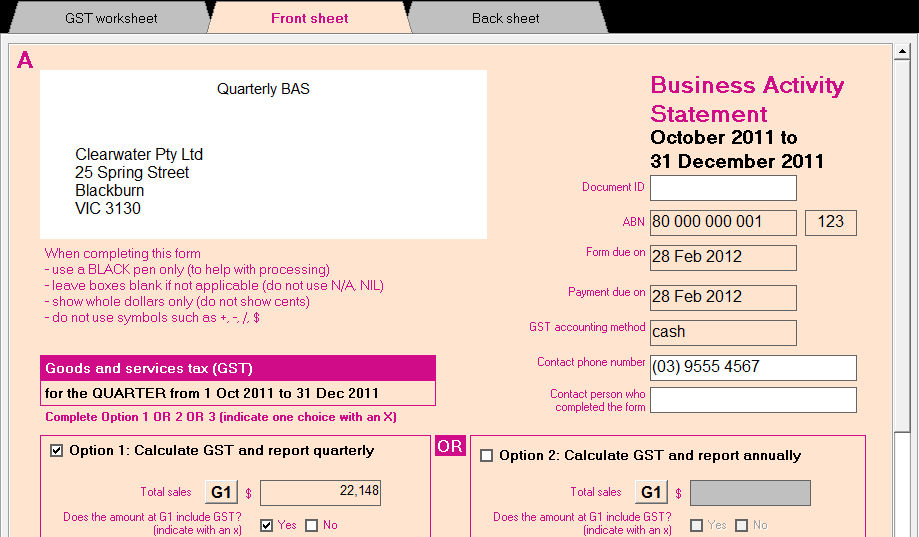

Important FBT Return Dates and Deadlines

The FBT year runs from 1 April to 31 March each year, which is different from the standard financial year. If you have provided reportable fringe benefits during this period, you must lodge your FBT return by 21 May following the end of the FBT year.

Lodging your FBT return on time is critical to avoid penalties and interest charges. If you miss the deadline, you may request a concession for late lodgement, but these are not guaranteed and should not be relied upon as a standard practice.

The Benefits of Using an Accountant for Your FBT Return

Navigating FBT regulations can be complex and time-consuming. Errors in calculation, reporting, or lodgement can result in costly penalties or missed opportunities for tax savings. Here’s how an experienced accountant can help:

Accurate Record-Keeping: We help you implement best practices for tracking and documenting fringe benefits throughout the year, ensuring you meet ATO requirements.

Maximizing Tax Efficiency: Our accountants identify legitimate ways to reduce your FBT liability without compromising compliance, such as utilising exemptions and concessions where applicable.

Timely Lodgement: We prepare and lodge your FBT return promptly, managing deadlines effectively and even assisting with concession applications if unforeseen delays occur.

Peace of Mind: With professional oversight, you can be confident that your FBT obligations are handled thoroughly, freeing you to focus on running your business.

At Digital Accounting Solution, our team of qualified accountants stays up-to-date with the latest FBT legislation and guidance. We provide personalised advice tailored to your business structure and industry, helping you manage this important tax efficiently and effectively.

Confused about your obligation

Contact our small business tax accountant to know about your obligations